Perfect time to write this blog as we’re right in the middle of kicking off a fundraise for our startup, and naturally you’d expect this blog to be an easy one to write…

Well, it’s proving to be a little more challenging than I’d expected. I know what you’re thinking hmmm…

“he’s not a YCombinator amlumni or a founder with multiple exists, so what does he know about pitch decks”.

Prelo is my third Startup, the 2nd one was an AI recruitment platform not that sexy I know, but in 2017 AI kinda was a thing 💪. I’ve been through a lot of pitches, call-backs disappointments. I’ve received notifications, feedback and advise from Angels and VCs.

On one of my pitch decks was opened over 100 times by a Startup accelerator (I’ll not name names here). 😊 Hopefully I’ve settled you down enough to feel a little comfortable that I know a little about pitch decks.

For the occasional pitch deck tear downs, follow me on twitter (DMs always open) 📨

Ok, let’s get cracking folks 👇

💡 5 Things every investor wants to see in your deck

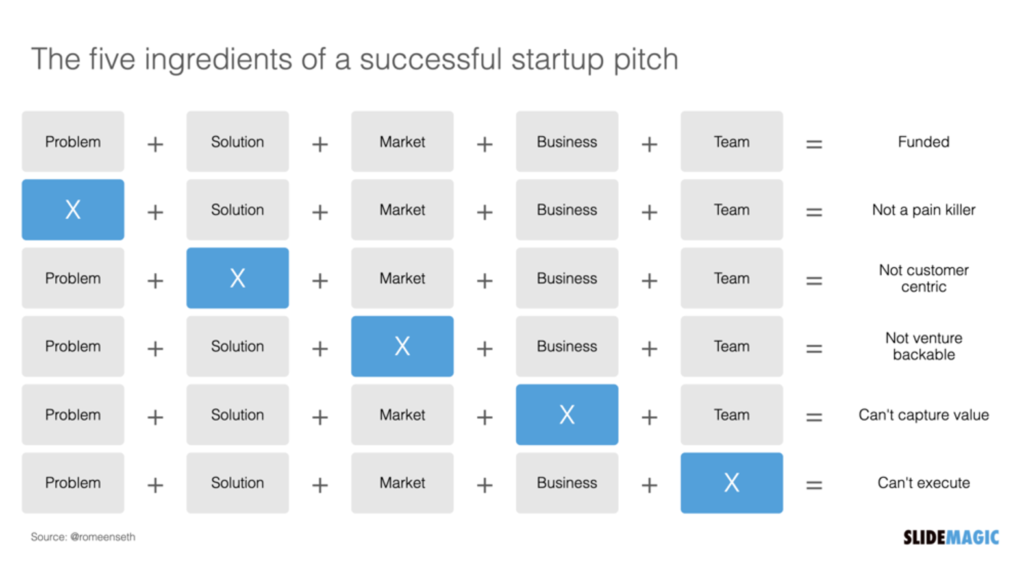

I’m going to start this section by referencing a tweet by Romeen Sheth, a serial entreprenuer who invested over $1MM into Startups last year, having listened to over 200 company pitches. So an insight for founders is this, do not reinvent the wheel, let’s leverage this framework provided by the investors who know what they’re talking about…

1 Problem

What is the problem that you are trying to solve? is it a “hair on fire” problem or an itch. Appreciate at this point that you may not have a problem, but rather an opportunity…perhaps you’ve identified a gap in the market based on your years of experience in a particular vertical. Your job is to convince the investor that this is a real problem/opportunity.

At Prelo we are trying to stop 90% of Startups from failing every year due to their inability to generate revenue. We know from first-hand experience that early-stage startups spend a LOT of money on lead-gen that produces an abysmal ROI

2 Solution

What solution are you proposing, is it a different way of doing the same thing or is it going to revolutionize an industry. Lastminute.com springs to mind. Their solution changed the way we booked holidays forever.

Prior to lastminute, I remembered spending a whole afternoon in the mall with my parents (typically where travel agents were based) speaking with a travel agent, looking through holiday brochures and finding flights…of course the likes of booking.com or expedia have now come and optimized the industry.

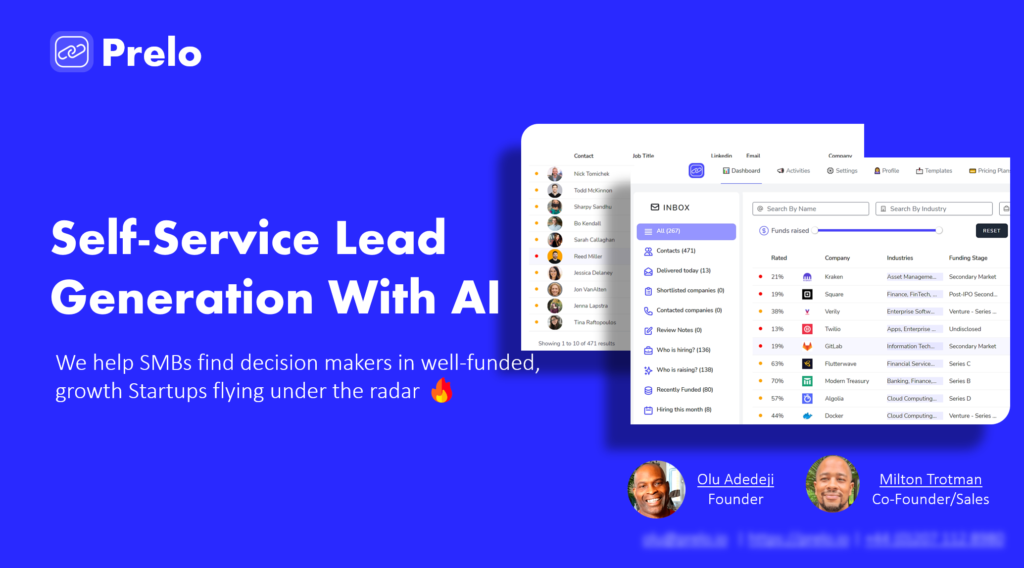

Our solution is simple, an affordable, data-driven platform that finds decision makers in fast growing tech companies that we’ve heavily curated. We’ve identified key data attributes like social media, funding data, hiring information and more..

3 Market

How big is this market, and is this an investment for an angel, P/E or a VC? Are you planning on getting to $300MM or $2MM ARR in 3 years. Typically this is where you get to determine the type of business you’re embarking on and how big your vision is. I’ve spoken to numerous founders and advised as to where they should be seeking investment.

The framework is very simple here, you need to convince the investor that the market you are targeting is big enough, that there is enough of the pie for you to get to your projected ARR in 3 – 5 yrs. Key numbers I typically add in here are Total Addresable Market, Servicable Addressable Market and the number of new customers emerging year-on year.

Our market is big enough, it’s $1.3BN and it’s growing at a 19% CAGR. There are approximately 305MM new businesses created every year globally with over 4.4MM in the US that are Startups, so serviceable addresable market is healthy

4 Business

The questions for founders to answer here are….

How are you making money?

What percentage of the market are you planning to capture and by when?

Usually it’s either subscription based, pay per use or a one off purchase. Sometimes it can be a combination of both depending on your product. The percentage of the market you plan to capture is entirely based on your price point and specifically your go to market strategy. Is the business model scalelable and are you the team to scale it.

At Prelo for instance we are a subscription based platform, however our route to generating traction is to offer specific one-off deals to help us understand our price point and go to market strategy.

Prelo is a subscription platform with a freemium plan. We charge SMBs and early-stage Startups to use our services

We will capture 3.4% of the $1.3BN market in the next 5 years and we understand the competitor landscape in this vertical

5 Team

Your team is important but this typically goes to the back of the pitch deck, unless perhaps you and your founders are ex-google, ex-Uber, ex-Airbnb or have multiple exits under your belts.

For us we are not so lucky, ok I’ve worked at Microsoft many moons ago and have spent 2 decades in investment banking, I’ve built teams and scaled teams globally, I used to be a techie then became a project manager. my co-founder is a sales guy he is bloody good at sales. So good that he trains other sales peaple. He’s also built strategic teams globally.

The point I’m making above is that you need to build a team with a diverse set of skills to give the investor confidence. Confidence that you and your team can execute your business strategy. I’m not saying that you couldn’t be a soloprenuer I’ve seen some uber successful solo founders.

I just know from experience especially with angel investors writing checks that, if you were to die tomorrow…what happens to their investment. It is a simple process for them to try and de-risk their investment

🔥 Get more investor meetings with a 3-page deck

If you’ve written and/or reviewed as many pitch decks as I have, you’ll realise that there’re sooooo many different ways to write your deck, while adhering to the framework I shared above.

(Framework – Problem, Solution, Market, Business & Team)

Nothing focuses you more than writing an executive pitch deck, why? You have zero room to for “gap fillers”. It needs to be succinct, every statement must convey the exact message you want the investor to understand.

I’d say writing an executive deck is much harder than writing a full deck, but here is the trick, if a 3 page deck can get you into a meeting with an investor, the conversation becomes so much easier. Getting the meeting indicates that your problem and the solution generated an interest, the next step is to convince them investor about your WHY?

Why are you the person to take this to the next stage, why is this product wanted now. Hey, get the meeting first, and you can do that with a 3-page executive deck

Pitch Deck Structure

The cover page

use this to communicate details about your founders (the founding team specifically) and link to their LinkedIn and your website for investors to get more information. Add team member’s picture and add their job role.

The 1st page

Split your page into 3 and create headers Problem, Solution and Market information. Use infographics to communicate 50% of the problem

The 2nd page

your second page here will be similar to the 1st page, split this page into 3 sections, Business Model, Growth, Investment (Ask) and squeeze financials along the bottom of your page. The investment section you need to get this right, present this in a way that demonstrates how long the investment is expected to last and what you expect to use the funds for.

At the bottom of this page, squeeze in a timeline of your expected financials, simple go with your ARR (annual recurring revenue) and state broadly what you expect to be doing at each stage. Make some assumptions, show the investor you understand that it’s not going to be smooth sailing. How do you do that, well research, what is the average lifetime value (LTV) of your customers, look at similar products and baseline yours with the industry standard.

The 3rd page

until recently, I’ve always left this out and stuck to 2 pages, but I figured that sometimes it’s difficult for investors to conceptualize the solution so you may want to add this section for the product.

If you have an MVP this is a perfect place to share some screenshots. Make sure it’s big enough so that the information is legible. Nothing worse than a screenshot that no one can see the detail.

You are done! that is all you need. Now send it to a friendly investor and/or someone who has been successful at multiple funding rounds and exited once or twice.

For more information on getting your deck in front of an investor, or just browsing investment data about who is raising in your vertical 👉 check out Prelo

On twitter : 🐤 @oluadedj

subscribe : 📰 prelo newsletter

Until the next time!

Olu

Founder, Prelo

I tweet about helping founders win!