It’s 7pm in London and Stephane Nasser just hopped on a zoom call to discuss the venture capital ecosystem and how his fundraising platform, OpenVC is opening doors for founders and accelerating their fundraising. With OpenVC, Steph has set out to advocate for founders by democratizing access to investors. 🎉

Stephane is the cofounder of OpenVC, what’s funny is that I’ve been promoting OpenVC for the past year. I’m very happy to say that we formed a partnership this year. 🚀

I’m looking forward to finding out how OpenVC can help my Startup community find the right investors for them.

…but before we get started, I’d love to connect with you!

Soooo, let’s do it follow me on twitter (DMs always open) 📨

Welcome to the Founder Stories Podcast Stephane, and thank you for joining us today. I’m interested in finding out about you and your journey into entrepreneurship.

💡 How did you start building a fundraising platform?

I was born in France and come from a family of small business owners. I think that’s where I get the entrepreneurship bug.

At an early age I had that sense of ownership, responsibility and taking matters into your own hands. As I got older I also started loving technology software. The Internet was a release for me, it was a window to the world from my little French bedroom.

I graduated from Business School and joined a Microsoft Accelerator in Paris. Then I moved to the United States and joined a consulting firm in San Francisco called Fabernovel.

They provided boutique consulting services, and they specialized in innovation consulting for large corporations. There, I acted as a middleman between technology companies in the Bay Area (San Francisco + Silicon Valley) and large corporations from Europe and Asia.

That was a surprising experience because you get involved in these high level meetings and you discover the hidden side of the moon. Then back in France I started the first startup in biotech which crashed in flames. My second company took a very different approach, it’s OpenVC. It started as a side project that is growing very nicely. So we’re very happy with that.

💡 How did you find your co-founder Lucas?

Finding the right co-founder is a huge challenge. Some people say “hey we co-founded at university” others say “we met during the accelerator programmes”.

People just grew up with their co-founders, while others go out and find theirs. I actively went looking because I have skills nobody is trying to plug. (laughs)

As I go through my story, and I think it’s actually an excellent question, because the game for finding a co-founder has dramatically changed in the past like 2-3 years.

I didn’t know Lucas before I started OpenVC. I started an Airtable database of ideals and this was the initial prototype for our Startup. You can call it the Alpha version.

Then I went to this Facebook group called French Startup Cycle. I found the group to be a very positive group. Most of those groups are not so good, but this one was great and I went there and said

“Hey guys, I built this database, it’s a fundraising platform. Do you know anyone who codes to build a front end? I cannot code even to save my life.”

Then this guy popped up in the comments saying, “Hey, I think your product is very cool” and that’s how we started this together. It was because of course, we haven’t met in person for a year because we’re not in the same area in France so we work remotely. Hoping and initially it was supposed to be and eventually met after maybe one year working together. That’s when we first met in person.

💡 Tell us your secret to building a fundraising platform?

When you’re a non-technical startup founder, like myself, and you cannot code it’s very, very hard to find a great tech person to partner with and for very good reasons.

They have plenty of opportunities. There are a lot of, startup founders with great software projects or startup ideas out there.

So how do you tell the good from the bad?

With tools you can actually build a first very basic version of your product. Go out there, show it to clients and start generating revenue, like you guys did with Prelo.

Honestly, I’m very deep into tools and I can vouch for it. The barrier to entry for building Startups has decreased dramatically, especially a complex investor matching, fundraising platform like OpenVC.

The secret to building great products is to build just what you need to to show traction and to convince people that you’ve validated the market. You can prove things and do things by yourself and that’s how you grow. Your next challenge is to go out there and talk about your Startup. Go out there and expose it, share it and get traction.

You will get lots of interest and among those people will be your first customers or a cofounder. Your first partner is your first investor. So I think it has changed again because it’s not, it’s not a push approach now it’s a pull approach. You go to all those platforms, Twitter and LinkedIn and you get the word out. And then good things will come to you. That’s my approach to building a successful Startup.

💡 What were your biggest challenges as a Startup founder building a fundraising platform?

Everyday you have a different initial challenge, so I’m going to just try to mention the major ones.

So the first one was cracking the technical aspect of building our Startup, which is not a challenge for a tech person, but which it was a challenge for me as a non-technical founder.

Next challenge tackling the chicken and egg situation you have when building a marketplace like a fundraising platform. You need investors and founders.

You know, we needed to have something with an initial value proposition like a list or something for people to look to find value in it.

The third was to attract traffic because the concept of open doesn’t require people to be active on the platform, we just need to have some data there and then it drives traffic on one hand and then we use the traffic on the supply side and then it’s kind of you can activate the feedback loops.

💡 Where do you see your fundraising platform in 10yrs?

I wish I had an answer. You know, there are some projects you start with the vision already designed. Then there projects that organically grow by themselves and that’s where we are.

We have to believe that OpenVC is better than what exists today. Then we wanted to fix the deal flow sourcing experience by the founders. So we did it and then, what’s the next thing we’re gonna fix? So that’s how we approach things. It’s very pragmatic. It brings value without having to confirm by roadmap. We don’t have investors so we’re free to do what we think makes sense, and that’s how we have the vision.

I hope you know ten years from now OpenVC will drive 50% of the deal flow in the VC market and eventually be responsible for deal flow globally.

One thing I would like to do with our fundraising platform is to really improve the efficiency of the initial match between founders and investors.

💡 How did your startup identify inefficiency in the fundraising ecosystem?

You have to look at the way VCs source Startups as a funnel or as a journey. The top of the funnel adopts a “spray and pray” approach while the bottom of the funnel or the final parts of the journey are pretty standardized and efficient with due diligence and execution of the deal.

So on one hand, the VC industry is effective, but it’s not efficient enough because the good VCs have enough deal flow. So they don’t feel like they need more.

Unfortunately for founders, they’re expected to hustle, so while it’s broken for us founders, it works well for VCs. I think the reason for that is that it’s so polluted.

There’s so much noise and so few signals, and that’s why it’s difficult to design a full solution, because you have to optimize.

I’m building our fundraising platform for efficiency, and for that we chose to go with an open and free model. That’s basically the Wikipedia model. Because from the moment you try to monetise you are going to lose 99% of both sides and you’re not going to track the really good ones.

And there were great ones you have to send to a VC. That’s not a game of volume, it’s a game of quality to get more value. You know, I captured 10’s of thousands of opportunities for months, as long as I can flag the top five correctly we are winning. To win, you have to build this very wide funnel, with very little barriers to entry. For that, an open model makes the most sense, and the startup matching models are very difficult to make using machine learning to help them match founders to investors.

The top of the funnel is very large and VCs want to make sure they never missed out on a good deal when in fact they miss out on a lot of good deals. A VC will do 1000 interviews every year, maybe, and only invest in, maybe 10 people, if that. Our job is to optimize the deal flow at the top of the funnel.

💡 What advice would you give a first-time founder?

Play by the rules and design your own path in and around that space. But be aware that being a Startup founder has its codes, and you should know how to speak tech and handle those rules for your own benefit. Find the right cofounder if you need one rule of engagement. Where are you going to market? Creating a pitch to investors, telling your story and writing.

💡 What do you need help with?

We need feedback on the product, we’re our building our fundraising platform brick by brick and we are doing it slowly. We are also both working full time so we have little time and resources to build because we’re bootstrapped. So it matters that we build exactly what our founders and VCs want. I mean we built it right the first time. So any feedback, feature request, suggestions, reports, you know, anything from our customers is the most precious thing we can have right now.

💡 How did you hear about Prelo and how has it supported you?

A friend who is a fundraising advisor sent me a link to Prelo through WhatsApp. I was like, OK, I need this. I think it’s the fastest software purchase I’ve ever made, I didn’t think twice. It’s helped me reach out to companies looking for funding who didn’t know about OpenVC. It’s basically everything we need in one box ready to fire!

It is an absolute pleasure to speak to you today. You need to know about going OpenVC. OpenVC is helping with the initial match between founders and investors.

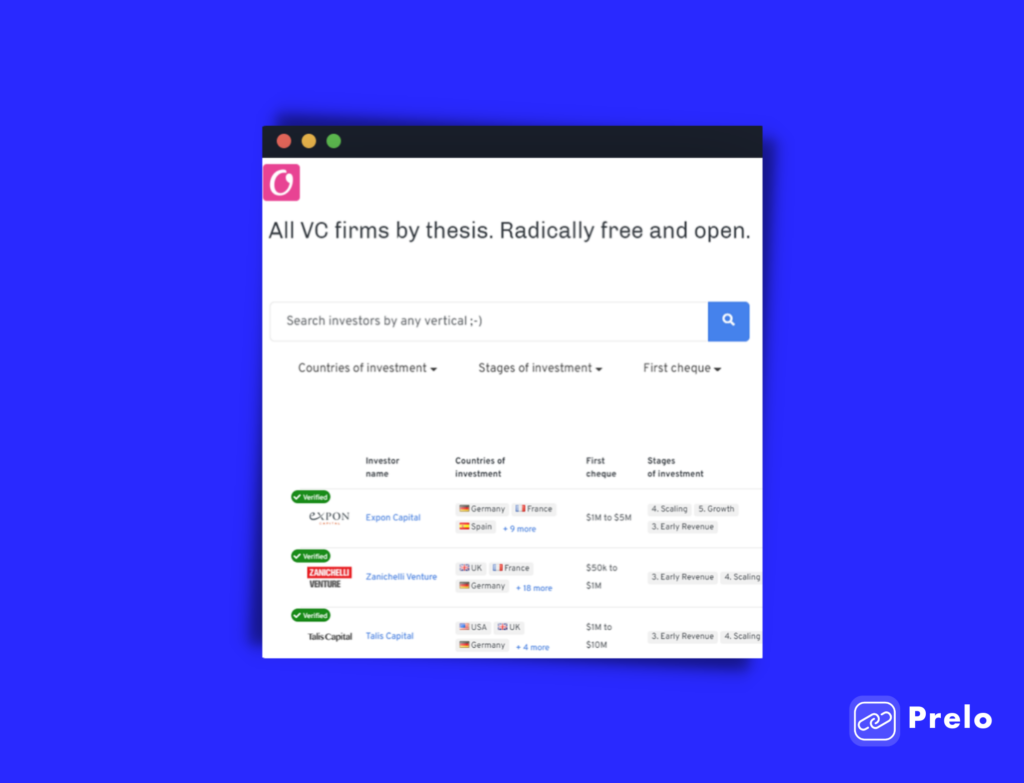

Website: www.openvc.app

Twitter: https://twitter.com/openvcapp

Tired of pitching to Startups with zero budget?

👉 Try Prelo

Prelo connects Solopreneurs to recently funded Startups in 3-Clicks

💡 Access over 1 million highly curated decision makers from well funded Startups

😲 Discover Emails and Business Contacts in seconds

🎯 Send super targeted emails to well-funded Startups and 10x your revenue

On twitter : 🐤 @oluadedj

subscribe : 📰 prelo newsletter

We’ll catch up again soon, many blogs coming up.

Olu

Founder, Prelo

I tweet about helping founders win!