In this article I’ll uncover the latest trends in startup funding to help you create a focused Prelo dashboard for the next 6 months

This blog will be a little different to previous blogs, because I intend to focus the funding trends on Startups that raised Angel investments through to Series E.

The trends from this article will lay the foundation for the strategies you’ll employ as a Prelo customer to discover decision makers in Startup.

I will breakdown the funding received at each of the funding stages mentioned and dive into the industries raising the most funds.

I won’t discuss fundraises by cities this month because remote working is more prevalent, so to some extent the physical locations matter less.

Time to get into the article and learn a little more about the countries and the Startups that raised $8.9Bn in May.

Startup Funding received a Tepid Reception from Investors last month

The data in this article will not only focus on the countries that received investment, it will share exactly how the $8.9bn was distributed across the funding stages.

Use the data insights from this blog to design a strategic outreach guaranteed to get you more discovery calls over the next 6 months

Interested in learning how to apply our suggestions to your outreach strategy, simply follow this guide to create Industry targeted Startups on Prelo.

How was $8.9bn distributed amongst Angel Rounds, Series A, B, C, D, E ?

8 Funding Stages were investigated in this blog and I’ll break down the amount raised by each funding stage and by each country.

We are not comparing Startup funding trends in May with the trends shared in April, because May is hyper-focused on Equity funding rounds prior to IPO.

- Angel Rounds ($29.4m)

China registered companies led the Angel rounds with a staggering $10.6m in total investments raised. The United States came a close second with $10.3m. Startups from Brazil, Switzerland and Chile make up the top 5. - Pre-Seed ($109.3m)

As we’ve had in previous months, the United States close out top position with $51m raised by Pre-Seed Startups. Followed by UK, France, The Netherlands and Singapore. - Seed ($763m)

No surprise here, as U.S. Startups raised more than 50% of Seed rounds. A total of $422m was raised in the United States, swiftly followed by India, UK, Germany and Australia - Series A ($1.8bn)

United States lead the way with $995m, worth noting that UK, France, India and Canada complete the top 5 positions. - Series B ($1.9bn)

United States Startups raised $898m with Singapore, Canada, France and India finishing off the top 5 positions. - Series C ($1.7bn)

Funding is dominated by United States with $1.2bn whilst German, Indian, Japanese and South African Startups finish in the top 5. - Series D ($1.1bn)

Startups from the United States again closed out more funds with $681m. The other countries in the top 5 are UK, Canada, France and India. - Series E ($240m)

Interestingly, the only Startups that closed Series E rounds were from United States and India. $220m and $20m respectively.

Key Startup Funding Trends in May’s investment landscape

In this section, I’m going to share the funding trends required to help you build a sales pipeline of the recently funded Startups you need to grow your business.

I’ll cover typical trends like, top countries raising funds, top industries raising funds and I’ll also share specific data about some investment rounds of interest.

But first, let’s explain what is meant by Equity Based Investing.

What is equity based investing ?

Equity based investing in a Startup is an investment in a company where money or services of a pre-agreed value is invested in exchange for the shares in the company.

These shares are not tradable on the stock market and typically, this type of investment occurs between a Startup’s Angel round and a Series A, B, C, D, E rounds.

For context, here are some examples of a non-equity based investment:

- Debt-financing

- Loans

- Grants

- non-dilutive investment options.

Top 10 countries with the highest VC Funding Rounds in May

While a total of $7.7bn (excluding $1.2bn of Grants) was raised by 22 countries in May 2023, across Angel, pre-seed, Seed, Series A, B, C, D and E rounds, we focus only on the top 10.

At the top of the list is the U.S. with $4.48bn. The Startups raising VC funds at a similar stage in the United Kingdom are a distant second with $641.8m raised.

| Country | Total Raised ($) |

| United States | $4,482,363,075 |

| United Kingdom | $641,825,744 |

| India | $439,065,071 |

| France | $382,086,686 |

| Germany | $335,059,205 |

| Canada | $311,838,044 |

| Singapore | $291,322,920 |

| Japan | $124,655,159 |

| Switzerland | $111,680,551 |

| The Netherlands | $103,400,331 |

Table 1.0 highest Startup Investments across (Angel, pre-seed, Seed, Series A, B, C, D, E)

Top 10 Industries showing Startups funding trends to Series E

Similar to the breakdown of funding across countries in table 1.0, I will share a similar breakdown across industries.

Comparing countries and industries across the same landscape of funding rounds makes it easier to build an outreach strategy.

| Industry | ($) total raised |

| HealthTech | $2,071,718,276 |

| A.I. | Robotics | $1,860,609,619 |

| FinTech | $1,191,518,679 |

| CleanTech | $518,954,107 |

| E-commerce | Consumer | $440,896,145 |

| Construction | Manufacturing | $377,695,750 |

| SaaS | $227,415,008 |

| MarTech | $170,507,057 |

| Information Technology | $166,876,165 |

| EdTech | $123,363,477 |

Table 2.0 Top 10 industries raising early stage funds (Series A – Series E, Angel, Pre-seed, Seed, Crowdfunding)

HealthTech lead the way, with AI & Robotics coming a close second. As we’ve been reading in the news, VCs appear to be very interested in Startups doing AI.

To prove my point, just this week the famous platform Synthesia just raised a Series C round at a staggering $90m on a $1bn valuation.

FinTech, CleanTech and Consumer Startups take up the remaining positions of the top 5 industries in the list.

Top 10 Industries showing early stage Startups funding trends

For the purpose of this article, we focused on industries that raised Crowdfunding, Angel, Pre-Seed and Seed rounds. Companies in this stage of funding are regarded as earl-stage Startups.

HealthTech leads the early-stage rounds with $220m in VC-funds. This is closely followed by FinTech Startups raising $142m in funding.

SaaS, and AI & Robotics take third and fourth positions respectively. For more information check out the table below.

If you are interested in distilling the make up of each of Prelo’s industry hierarchy, then read Prelo’s Startup funding industry breakdown blog.

| Industry | ($) total raised |

| HealthTech | $220,117,004 |

| FinTech | $142,142,402 |

| SaaS | $93,495,792 |

| A.I. | Robotics | $87,060,174 |

| Miscellaneous | $81,108,328 |

| Construction | Manufacturing | $49,177,449 |

| Information Technology | $42,353,627 |

| CleanTech | $30,711,298 |

| MarTech | $30,635,976 |

| E-commerce | Consumer | $28,313,247 |

Table 3.0 Top 10 industries raising early stage funds (Angel, Pre-seed, Seed, Crowdfunding)

Startup Funding Trends in May – Picking Top Performers

Unlike previous months where I shared data about the top cities across all investment types, we are going to be super focused on building an outreach strategy targeting Startups.

An outreach calendar is a plan with a timeline on how your Startup settings should be setup to generate a consistent stream of funded Startups.

How to build your B2B Outreach Strategy targeting top Startups

I will write a separate article on creating quarterly outreach strategies to get the most out of Prelo. For now let’s keep it simple.

For the purpose of this article, I’m going to create a highly effective outreach template based only on Startup funding trends in May.

My focus for the funding rounds is Early Stage plus Series A – Series E Startups.

What is the Strategy for creating a Startup outreach plan on Prelo?

- Identify the top 5 countries by industry that raised the most investment (see table 1.0).

- Similarly, list the top 4 industries for the Startups that raised the most investment (see table 2.0)

- Then Build out your 1st matrix table

Identifying countries to feature in your Startup Outreach calendar

For the purpose of this exercise, I will pick the top 5 countries as seen in table (4.0)

- United States

- United Kingdom

- Germany

- Singapore

- India

Picking Industries to target for Sales outreach in your calendar

It is very clear based on the above data that the industries worth focusing on are :

- HealthTech

- AI & Robotics

- FinTech

- CleanTech

Review current Industry settings and get familiar with your Prelo Settings

Take some time to learn more about the Prelo industry settings so that you can create the right strategy while targeting funded Startups.

Once you’ve reacquainted yourself with the setup, you should be in a better position to build your outreach strategy.

How to Configure Your Settings based on Startup Funding

Watch this video and follow the instructions to setup a country & industry scope in Prelo.

Now let’s use the table below to build your super focused outreach segmentation strategy.

| Industry | ($) Total raised | Country |

| HealthTech | $1,346,412,334 | United States |

| A.I. | Robotics | $1,184,697,434 | United States |

| FinTech | $642,180,000 | United States |

| CleanTech | $382,077,988 | United States |

| A.I. | Robotics | $305,706,824 | United Kingdom |

| Construction | Manufacturing | $214,518,437 | United States |

| HealthTech | $205,098,771 | Germany |

| FinTech | $202,600,000 | Singapore |

| E-commerce | Consumer | $185,582,238 | India |

| E-commerce | Consumer | $170,064,517 | United States |

| HealthTech | $168,478,331 | France |

| MarTech | $146,718,066 | United States |

| HealthTech | $131,175,003 | Canada |

| HealthTech | $128,556,575 | United Kingdom |

| A.I. | Robotics | $125,833,470 | Canada |

| SaaS | $85,550,000 | United States |

| A.I. | Robotics | $79,236,224 | India |

| FinTech | $77,800,000 | South Africa |

| FinTech | $75,991,182 | United Kingdom |

| CleanTech | $74,070,263 | Japan |

| EdTech | $72,862,500 | United States |

| Energy | $54,000,000 | United States |

| A.I. | Robotics | $52,862,559 | Switzerland |

| Construction | Manufacturing | $50,119,578 | Switzerland |

| SaaS | $48,909,315 | France |

Table 4. 0 – top 25 Startup Industries and Countries raised $6.7bn for early-stage and Series A – Series E Startups

Build Your Outreach Calendar to Target Early-Stage and Series A – Series E Startups

Start with the recommendations below and work your way through the list.

| Week 1 | Week 2 | Week 3 | Week 4 |

| HealthTech | AI & Robotics | FinTech | CleanTech |

| United States | United States | United States | United States |

| Germany | United Kingdom | Singapore | Japan |

| Canada | Canada | South Africa | E-Commerce/Consumer |

| United Kingdom | India | United Kingdom | United States |

Table 5.0 – Prelo’s Recommendation

Above is a simple but effective 4 week outreach calendar, focused on HealthTech in Week 1 and prioritizes United States Startups.

This is followed by Startups from Germany, Canada and the United Kingdom prioritized by total funding amount.

Similarly in week 2 AI & Robotics Startups from the United States would take priority, followed by United Kingdom Startups.

The Process is simple, it takes the industries from table 4.0 and shares a list of countries based on investment raised.

A simple repeatable calendar based on current and historical data to help you hyper target funded Startups by industry and location.

What Does This All Mean for Prelo Customers?

The data from May‘s Startup funding gives you a head start in understanding the trends, industries and countries attracting VC investments.

I shed light on these trends to help you curate the right Startups in your Prelo dashboard . Having the right Startups in your dashboard ensures that you consistently uncover growth Startups.

Take advantage of the monthly funding trends to review and optimize your Prelo settings to focus on Startups at the right stage of growth.

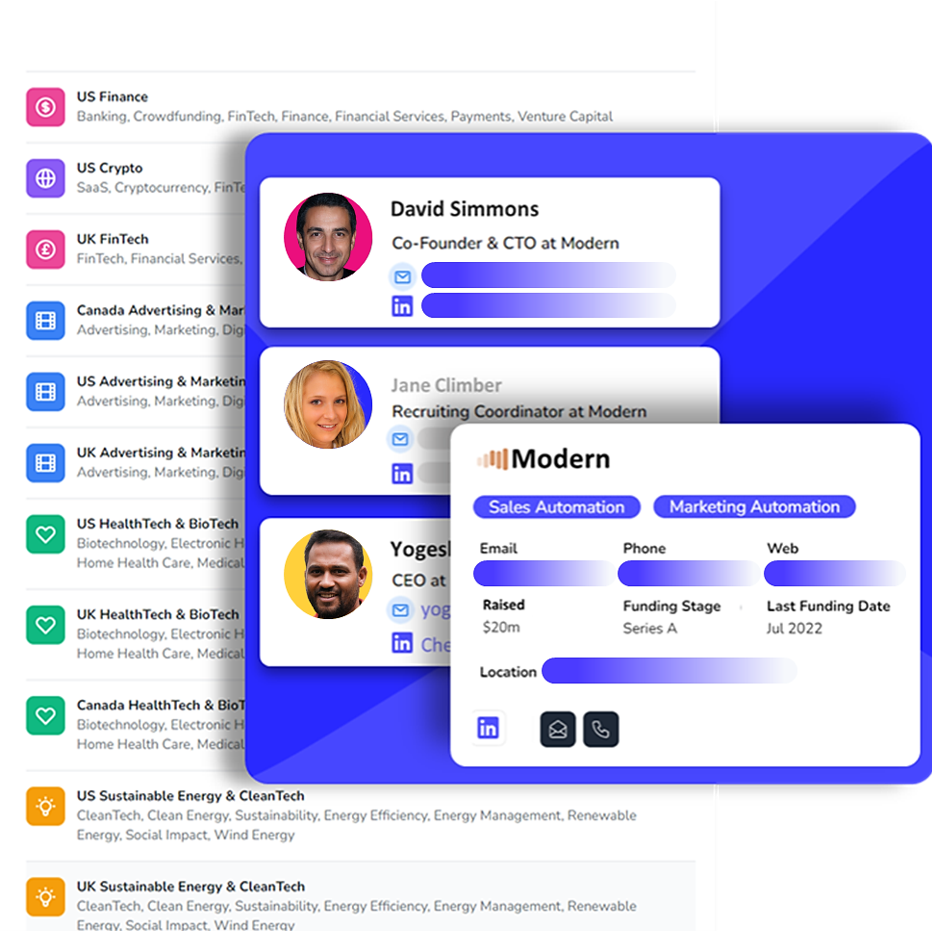

The Secret to Setting up your Prelo dashboard

The secret to making sure you have the latest funded Startups in your Prelo dashboard, is understanding what sub-industries to add to your current Prelo settings.

As mentioned last month, we have updated our industry settings to simplify access to funded Startups categorized by industry

Conclusion

The Startup Funding Insights provided in this blog offer valuable information to enhance your outreach campaigns on Prelo.

By leveraging recent funding data, you can target countries, cities, and industries with high potential for growth.

Use the provided tables to optimize your Prelo settings and receive a consistent stream of high-performing founders running well funded Startups.

Stay ahead of the dynamic funding landscape and maximize your outbound marketing strategy with this invaluable resource.

With the right strategies and some luck, success in the startup world inevitable.

Tired of pitching to Startups with zero budget?

Try Prelo

💡Access to over one million qualified leads from well-funded Startups

😲Discover Emails and Business Contacts of decision makers in seconds

🎯Send targeted emails to well-funded Startups and 10x your revenue