In this blog I take a look at the latest trends in startup funding across different sectors in April.

Despite the current economic downturn, there are plenty of funding successes for FinTech, HealthTech and AI focused Startups.

I’ll use those trends to give you an insight into the strategies used by Prelo customers to consistently find decision makers in Startup.

If you’re looking for ways to increase your chance of success in targeting high-growth Startups, continue reading. 👇

The information from this blog will help you set up your Prelo dashboard for maximum conversion.

Before you dive in, here’s a short blog I put together to help you understand how Prelo’s startup industry categories work.

If you found that interesting and wish to learn more about startup funding stages then we have so much more for you!

Startup Funding in April : Can we put the “Fun” back into Funding?

Let’s jump into the data to uncover the top Startup sectors that received the most investment in April.

As mentioned earlier, this blog will help to hyper-focus your outreach strategy for targeting recently funded Startups.

We’ll make sure that the information shared here can be immediately applied to your Prelo settings.

Our focus is to accelerate your prospecting and help you to start engaging with high-growth clients that can pay for your services.

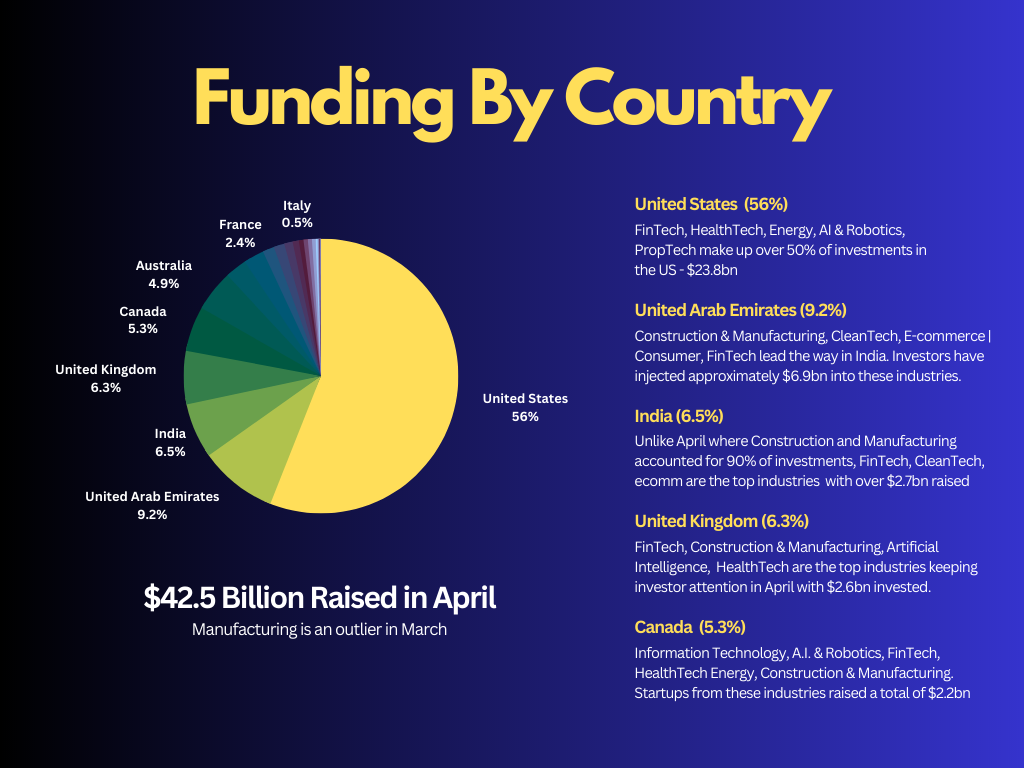

Top 10 Countries with the Highest VC Fundraises in Startups

These 10 countries were the leaders in terms of funds raised in the month of April.

When comparing the list in April with the Startup funding trends shared in March we can see that there are some differences.

The United Arab Emirates now shows up in second place, pushing India to third place.

Also it is worth noting that Switzerland and The Netherlands have now dropped off the list to make way for Mexico and Kenya in April.

| Country | ($) total raised |

| United States | $23,825,700,918 |

| United Arab Emirates | $3,911,400,000 |

| India | $2,753,340,444 |

| United Kingdom | $2,670,940,767 |

| Canada | $2,244,771,896 |

| Australia | $2,066,782,635 |

| Germany | $1,089,204,131 |

| France | $1,025,335,226 |

| Mexico | $579,260,456 |

| Kenya | $536,200,0000 |

| Total | $40.7billion |

Table 1.0 top 10 countries with the highest Startup Investments

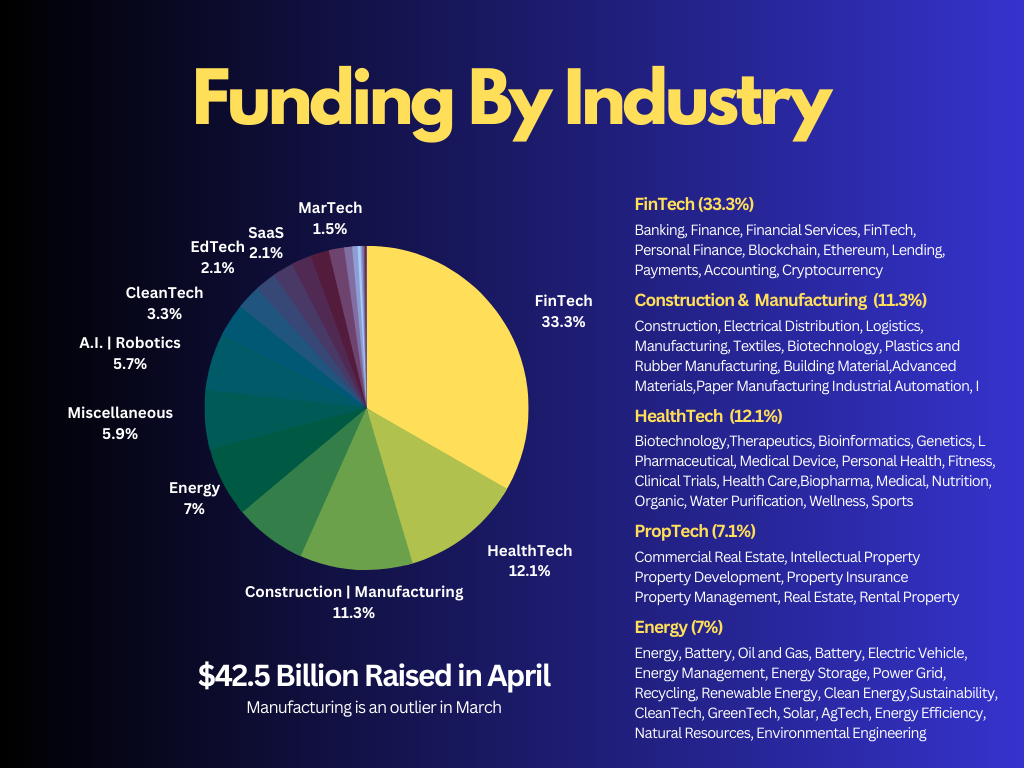

Top 5 Industries with the Highest Startup Investments

April investments across the Startup space (and some construction & manufacturing establishments) has dropped to $42.5 billion in April.

However, the top 5 industries that received the highest amount of investments have not changed.

As a Prelo customer planning an outreach campaign the industry strategy has not changed.

FinTech & HealthTech are still Startups you want to optimize your Prelo Dashboard to capture.

- Fintech

- HealthTech

- Construction & Manufacturing

- PropTech

- Energy

| Industry | ($) total raised |

| FinTech | $14,163,816,278 |

| HealthTech | $5,151,079,365 |

| Construction | Manufacturing | $4,787,487,486 |

| PropTech | $3,073,562,153 |

| Energy | $2,966,843,444 |

| Total | $30.1 billion |

Table 2.0 – Startups that raised the most Funding in April come from these 5 industries

Picking Top Performers and Managing Funding Outliers

As you can see, the FinTech industry alone attracted $14.2bn in investments which is down $11bn from last month.

Nevertheless, this highlights the consistency we’ve seen in FinTech as the top industry for Startups most likely to receive VC funding.

The UK and the US were the biggest beneficiaries in Fintech, with the UK $0.85bn, a $20m difference from last month.

Whilst the UK’s interest in FinTech Startups remained largely unchanged, I couldn’t help but notice the huge shift the US.

A 66% drop from $22.7bn to a disappointing $7bn in FinTech investments got me a little concerned initially.

A further dive into the data and we can attribute the large FinTech investments in April to a handful of Startups in Boston and Charlotte.

The HealthTech and Construction & Manufacturing industry came second and third respectively, with just $5bn and $4.7bn worth of funding raised by Startups in this sector.

Worth mentioning that Startup funding across these 5 sectors accounted for 70% of the overall Startup funds in April.

The Biggest Winners in the Startup Funding World

Now that shared some context around the top industries that raised the highest startup funding in April, let’s review them by location and dissect some of the funding updates by Countries and Cities.

Top 10 Cities with the Highest Startup Funding in April

I get it, United States is a clear leader in the Startup funding market, but there are other countries making significant gains.

UK, Canada and India have been consistently in the top 5, until this month. UAE has stolen second place with Abu Dhabi being the main city to watch out for.

Check out table 3.1 to see the distribution of funding by industry in the UAE. We had to breakdown the UAE to discover the top industries responsible for the

jump into second place.

| Country | City | ($) total raised |

| United States | Seattle | $4,560,237,555 |

| United Arab Emirates | Abu Dhabi | $3,911,400,000 |

| United States | New York | $2,537,062,726 |

| United Kingdom | London | $2,358,028,549 |

| United States | Los Angeles | $2,078,463,285 |

| Australia | Perth | $1,449,060,500 |

| India | New Delhi | $1,173,031,567 |

| United States | San Francisco | $1,078,957,652 |

| United States | Atlanta | $959,519,613 |

| United States | Allentown | $925,000,000 |

| Total | $21billion |

Table 3.0 – Top Cities that raised the most Startup Funding in April

| industry | ($) total raised | country |

| Construction | Manufacturing | 2,000,000,000$ | United Arab Emirates |

| FinTech | 1,896,400,000$ | United Arab Emirates |

| CleanTech | 15,000,000$ | United Arab Emirates |

Table 3.1 – Startup Funding By Industry in UAE (Construction & Manufacturing dominate)

What Does This All Mean for Prelo Customers?

The insights from April‘s Startup investments provide Prelo customers with a unrivalled opportunity to understand the trends, industries and countries that are attracting investor attention.

When you understand these trends, you are better equipped to setup your Prelo dashboard in a way that creates a scalable system to consistently target decision makers from high growth Startups.

It is worth noting, that customers use Prelo’s data to gain insight into the Startup funding market, using that knowledge to develop a highly qualified list of prospects looking for services.

There is no better opportunity than to use our monthly funding data to gain insight into emerging Startups at a global scale.

April Strategy: Setting Up Your Prelo Dashboard to Unlock Success

At the end of Q1, we shared some strategies with you on how to approach funded Startups. As we are half way through Q2, We want to refresh your strategies to improve your outreach with Prelo.

With all the VC funding insights I’ve shared with, you need to optimize your Prelo industry settings to give your Q2 outreach a well needed boost.

How to Configure Your Settings based on Startup Funding

Before you start, please watch this video and follow the instructions to setup a country & industry scope in Prelo.

Once you’ve watched the video, use the table below to build your hyper-targeted outreach segmentation strategy.

Start with the recommendations below and work your way through the list.

1st 2weeks – Create your country scope with two United States country configurations with focus on FinTech and HealthTech

If you do business in the UAE, you can see from the table below that the FinTech industry received almost $2bn in funding.

Simply add these to your Prelo Settings and explore recently funded FinTech companies in the UAE.

If your business does not extend to the UAE, then there are Startups in Canada and the UK worth researching.

Your Prelo setup shouldn’t include manufacturing & construction companies in the UAE, this is not considered as a strategic outreach setup.

Use the table below to optimize your Prelo configuration settings based on the most recent Startup funding updates.

| Country | Industry | ($) total raised |

| United States | FinTech | $7,912,081,280 |

| United States | HealthTech | $3,751,062,573 |

| United States | PropTech | $2,494,203,261 |

| United States | A.I. | Robotics | $1,848,859,041 |

| United States | Energy | $1,831,455,068 |

| United Kingdom | FinTech | $855,847,381 |

| United Kingdom | Construction | Manufacturing | $688,346,656 |

| United Kingdom | Energy | $424,881,582 |

| United Kingdom | HealthTech | $215,310,577 |

| United Kingdom | A.I. | Robotics | $146,376,595 |

| United Arab Emirates | Construction | Manufacturing | $2,000,000,000 |

| United Arab Emirates | FinTech | $1,896,400,000 |

| United Arab Emirates | CleanTech | $15,000,000 |

| Canada | FinTech | $768,596,141 |

| Canada | HealthTech | $317,513,796 |

| Canada | Energy | $291,428,559 |

| Canada | A.I. | Robotics | $240,476,692 |

| India | FinTech | $1,459,338,975 |

| India | CleanTech | $671,248,847 |

| India | E-commerce | Consumer | $94,359,426 |

| India | Information Technology | $84,732,710 |

| India | Energy | $81,113,313 |

| India | Food & Beverage | $46,112,351 |

| Total | $28.1 Billion |

Table 4. 0 – Startup Industries and Countries to target latest funding opportunities

Setting up your Prelo dashboard with Startup funding updates

One of the secrets to having the latest funded Startups in your Prelo dashboard, is knowing what sub-industries to add to your current Setup.

We have recently revamped our industry settings to make it easier for customers to access funded Startups categorized by industry

Conclusion

The Startup Funding Insights in this blog will help you identify countries, cities and industries most likely to respond to your outreach campaigns based on their recent funding status.

With this data and the tables I‘ve shared, you are well equipped to level up your Prelo settings so that you receive a consistent stream of high-growth Startups straight to your dashboard.

This blog is the quickest way to optimize your outbound marketing strategy in the Startup funding ecosystem.

Make sure to use this valuable resource to learn, plan and stay ahead of the fast–changing funding environment.

With the right strategies and a little bit of luck, you can make it big in the startup world.

Tired of pitching to Startups with zero budget?

Try Prelo

💡Access to over one million qualified leads from well-funded Startups

😲Discover Emails and Business Contacts of decision makers in seconds

🎯Send targeted emails to well-funded Startups and 10x your revenue